aurora sales tax calculator

An alternative sales tax rate of 7 applies in the tax region Aurora which appertains to zip code 50607. In no event shall the amount of tax to be held be less than 375 400 in Arapahoe County of 50 of the permit fee determination assessment.

Courtyard Denver Aurora Aurora Co 255 North Blackhawk 80011

You can find more tax rates and allowances for Aurora Cd Only and Colorado in the 2022 Colorado Tax Tables.

. The latest sales tax rate for Aurora IN. The Aurora sales tax rate is. Aurora Sales Tax Rates for 2022.

This rate includes any state county city and local sales taxes. This rate includes any state county city and local sales taxes. Wayfair Inc affect Missouri.

Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. An alternative sales tax rate of 881 applies in the tax region Denver which appertains to zip codes 80010 80012 80014 and 80019. Sales tax in Aurora Illinois is currently 825.

The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables. SD Rates Sales Tax Calculator Sales Tax Table.

If this rate has been updated locally please contact us and we. This is the total of state county and city sales tax rates. There is no applicable city tax or special tax.

Aurora is in the following zip codes. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. Aurora TX is in Wise County.

Aurora Cd Only in Colorado has a tax rate of 7 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora Cd Only totaling 41. The Missouri sales tax rate is currently. 5 lower than the maximum sales tax in SD.

The sales tax rate for Aurora was updated for the 2020 tax year this is the current sales tax rate we are using in the Aurora Illinois Sales Tax Comparison Calculator for 202122. Did South Dakota v. The New York sales tax rate is currently 4.

This is the total of state county and city sales tax rates. The latest sales tax rate for Aurora SD. You can print a 55 sales tax table here.

The Aurora Sales Tax is collected by the merchant on all qualifying sales. The Aurora Illinois sales tax is 625 the same as the Illinois state sales tax. US Sales Tax Rates MO Rates Sales Tax Calculator Sales Tax Table.

2020 rates included for use while preparing your income tax deduction. The County sales tax rate is 4. You can print a 8 sales tax table here.

The 55 sales tax rate in Aurora consists of 45 South Dakota state sales tax and 1 Aurora tax. The December 2020 total local sales tax rate was 8350. Did South Dakota v.

For tax rates in other cities see South Dakota sales taxes by city and county. What is the sales tax rate in Aurora New York. The 8 sales tax rate in Aurora consists of 4 New York state sales tax and 4 Cayuga County sales tax.

The County sales tax rate is. US Sales Tax Rates TX Rates Sales Tax Calculator Sales Tax Table. US Sales Tax Rates OH Rates Sales Tax Calculator Sales Tax Table.

The current total local sales tax rate in Aurora OH is 7000. An alternative sales tax rate of 675 applies in the tax region Centennial which appertains to zip code 80046. IN Rates Sales Tax Calculator Sales Tax Table.

For tax rates in other cities see New York sales taxes by. This level of accuracy is important when determining sales tax rates. There are approximately 213758 people living in the Aurora area.

The December 2020 total local sales tax rate was 7250. Remember that zip code boundaries dont always match up with political boundaries like Aurora or Buchanan County so you shouldnt always rely on something as. The minimum combined 2022 sales tax rate for Aurora Missouri is.

If this rate has been updated locally please contact us and we will. There is no applicable county tax or special tax. The current total local sales tax rate in Aurora TX is 7750.

2020 rates included for use while preparing your income tax deduction. Aurora is in the following zip codes. The December 2020 total local sales tax rate was also 7750.

From there it can determine the corresponding sales tax rate by accessing AvaTax our innovative cloud-based sales tax calculation product. The minimum combined 2022 sales tax rate for Aurora New York is 8. When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction.

The sales tax jurisdiction name is Venice which may refer to a local government division. The Aurora Iowa sales tax rate of 7 applies in the zip code 50607. Wayfair Inc affect New York.

How much is sales tax in Aurora in Illinois. The current total local sales tax rate in Aurora MO is 8850. The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe County.

The Aurora sales tax rate is 0. The sales tax rate for Aurora was updated for the 2020 tax year this is the current sales tax rate we are using in the Aurora South Dakota Sales Tax Comparison Calculator for 202223. While many other states allow counties and other localities to collect a local option sales tax Illinois does not permit local sales taxes to be collected.

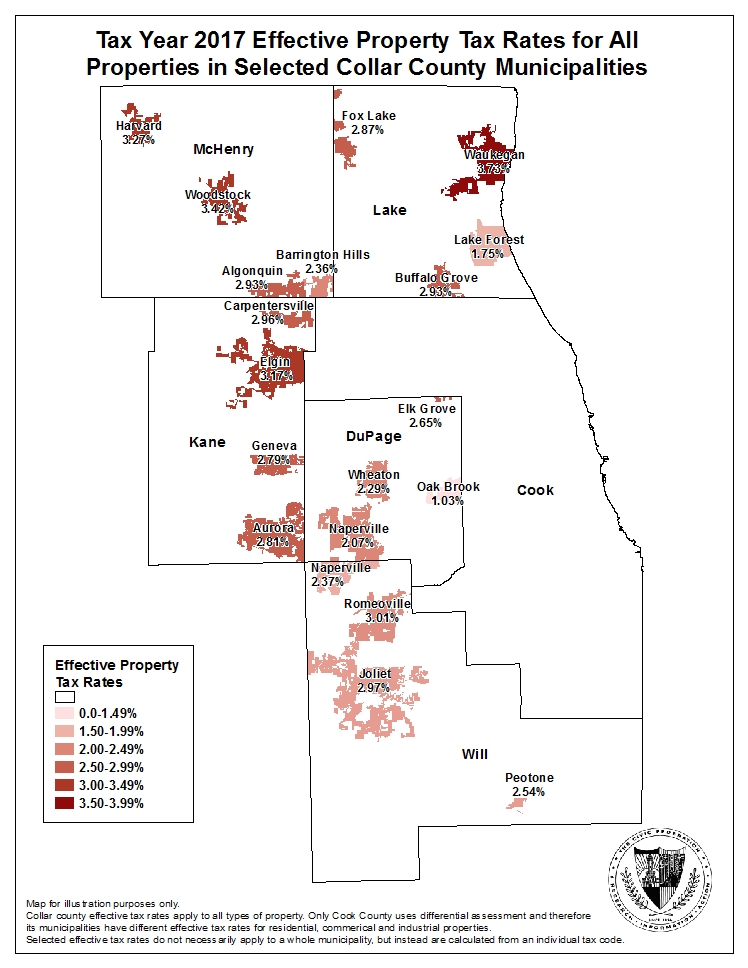

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Help I Don T Know What To Enter For Locality Grou

What Is The Sales Tax On A Car In Illinois Naperville

How To Calculate Cannabis Taxes At Your Dispensary

Illinois Car Sales Tax Countryside Autobarn Volkswagen

80016 Sales Tax Rate Co Sales Taxes By Zip

How To Use Tax Function On Calculator Youtube

Aurora Property Tax 2021 Calculator Rates Wowa Ca

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

How Colorado Taxes Work Auto Dealers Dealr Tax

Set Up Automated Sales Tax Center

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com